PART 2: HO CHI MINH CITY – Emerging city market or bubble risk?

10/10/2017RISING PRICES, FALLING RENTS – THOSE ARE THE REGION’S PROPERTY TRENDS

“If you are living in one of the financial centers across the region, for instance, Hong Kong, Singapore, Shanghai or Tokyo, prices for high-end and luxurious apartments are touching the unaffordable. If you then consider investing into a buy-to-let apartment then these cities are, in fact, not an attractive choice.”, says Timo Schmidt, Head of Sales at Indochina Properties, the brokerage arm of foreign investment firm Indochina Capital that has been a long-term player in Vietnam’s property market.

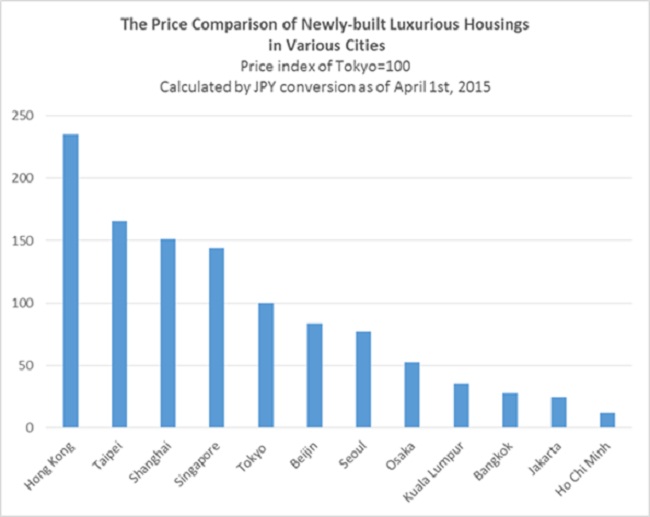

Figure 1. Price Comparison of Newly-built Luxurious Housings in Asia

Hong Kong and Singapore are two excellent examples of overheated property markets. Due to their relative political stability, personal safety, importance as key trade and financial centers as well as high quality of life, these are much sought after as the first choice for a residence in Asia. This has led to a flurry of foreign investors from mainland China – primarily in Hong Kong – and, in addition, Malaysian and Indonesian buyers for Singapore in particular. Driven by foreign investors and local speculators alike, the local property markets heated up severely over the past decade and governments have put measures in place to keep prices from spiraling further out of control. Those included, for example, excessive stamp duties and restricted access to lending for more than one property amongst others. Figure 1 shows the price index for comparable luxury properties in several urban centres across Asia. The index is based on Tokyo prices (=100) and shows that Tier 1 cities such as Hong Kong (2.4 times), Taipei (1.7 times), Shanghai and Singapore (1.5 times) are vastly more expensive than homes in Tokyo while the chart also shows that prices for apartments for sale in Ho Chi Minh City are merely a fraction of the cost of purchasing a comparable apartment in Tokyo.

|

Country |

Buying Price (USD/sqm) |

Gross Rental Yield |

Rental Income Tax |

Capital Gains Tax |

|

Hong Kong |

25,551 |

2.75% |

11.4% |

n.a. |

|

Japan |

16,322 |

2.66% |

3.4% |

15% |

|

Singapore |

13,748 |

2.54% |

15.1% |

n.a. |

|

India |

9,783 |

2.39% |

8.3% |

30% |

|

Taiwan |

7,112 |

1.57% |

25% |

20% |

|

Thailand |

3,952 |

5.13% |

2.7% |

35% |

|

Philippines |

3,952 |

6.13% |

24.1% |

32% |

|

Cambodia |

2,913 |

5.33% |

14% |

20% |

|

Malaysia |

1,827 |

4.53% |

20% |

5% |

|

Vietnam |

1,500 |

6-8% |

10% |

0% |

Table 1: Purchase prices, yield and taxation for property across Asian key cities

When rental prices in Tier 1 cities did not grow proportionally with the purchasing prices for property, the rental yields began to slip. Nowadays, most of those key markets do not offer attractive returns from lettings of residential property anymore, ranging from meager 1.5-3% per annum.

Those investors have started looking at emerging market based on the promising developments of secondary Asian key cities such as Bangkok or Kuala Lumpur where investors have seen property values increase dramatically in line with economic and infrastructure development.

Let us look at one of those markets in more detail.

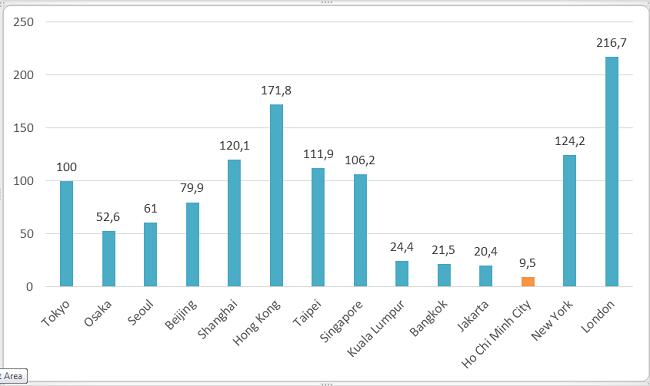

*Index number by city for the high-end condominium value per square meter of each surveyed city. Price index of Tokyo = 100

Figure 2: Value Comparison of High-end Condominium Units

CASE STUDY: BANGKOK – PROPERTY BOOM DESPITE POLITICAL TURMOILS

Bangkok, still years ahead in terms of development compared to Ho Chi Minh City, is an interesting benchmark. Between 2006 and 2016, Thailand and Bangkok have seen a myriad of political problems starting from a military coup in 2006 followed by airport closures, public protests, shootings and bombings intermittent chaos ruled regularly across the city over the past decade. Whilst political instability is a major factor for investment and more importantly so for Foreign Direct Investment (FDI), it is even more astounding that average property prices increased by 60% between 2009-2016.

Photo 3. Bangkok, Thailand (2016)

“If one examines the luxury segment only, it shows a clear trend. Whilst in 2007-8 there was still a pricing cap for luxury units of around USD4,400-6,500 per square metre with some exceptional – typically branded – residences fetching up to USD9,000 per square metre.”, Schmidt continues. “Having worked in Thailand’s property industry for over half a decade, it is quite easy to spot the trends of Bangkok luxury residences and draw conclusions on what we expect to happen in Ho Chi Minh City over the coming years.” Since then, the typical range for prime residences in the urban in-demand locations such as Phrom Phong, Langsuan or Sathorn-Silom has increased to a minimum price of USD9,000 per square metre. A record-setting transaction in 2015 fetched a square metre price of nearly USD14,000.

That means, on average the prices in prime locations nearly doubled in the past eight years. High acquisition cost for land in these prime areas is certainly a factor, often accounting for up to 60% of total development cost, according to a CBRE report. However, the reputation of the developer, the quality of the building, the facilities and unit mix as well as the branding of the project are all important aspects to assess the value of a luxury residence and whether a target clientele will find such prices acceptable. The price escalation was certainly driven, in part, by the launch of various hospitality-led ultra-luxury residences offered by renowned brands such as Sukhothai, St. Regis, Ritz-Carlton and Four Seasons as internationally branded residences will typically command a premium on pricing.

Photo 4. St. Regis Bangkok

The scarcity of inner-city land for development combined with the quality assurances that a reputable developer and international consultants promise are key decision-making criteria of prime inner-city projects. Those factors will strictly determine price development in those in-demand locations.

Related post:

HO CHI MINH CITY – Emerging city market or bubble risk? (Part 1)

HO CHI MINH CITY – Emerging city market or bubble risk? (Part 3)

Tiếng Việt

Tiếng Việt 한국어

한국어 +84 905 871 234

+84 905 871 234

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)